weaponized yield: spectra is live on katana

the dojo just got new weapons. weaponized yield.

spectra is now live on katana, unlocking a full yield trading arena for assets on katana, including AUSD and katana yearn vault tokens (yvvbTokens). for the first time, samurais can slice yield-bearing positions into two halves: principal and yield.

choose your own journey: steady discipline, max leverage, or balanced mastery.

spectra TL;DR

spectra is a permissionless yield protocol that transforms interest-bearing assets into two distinct components (plus LPs):

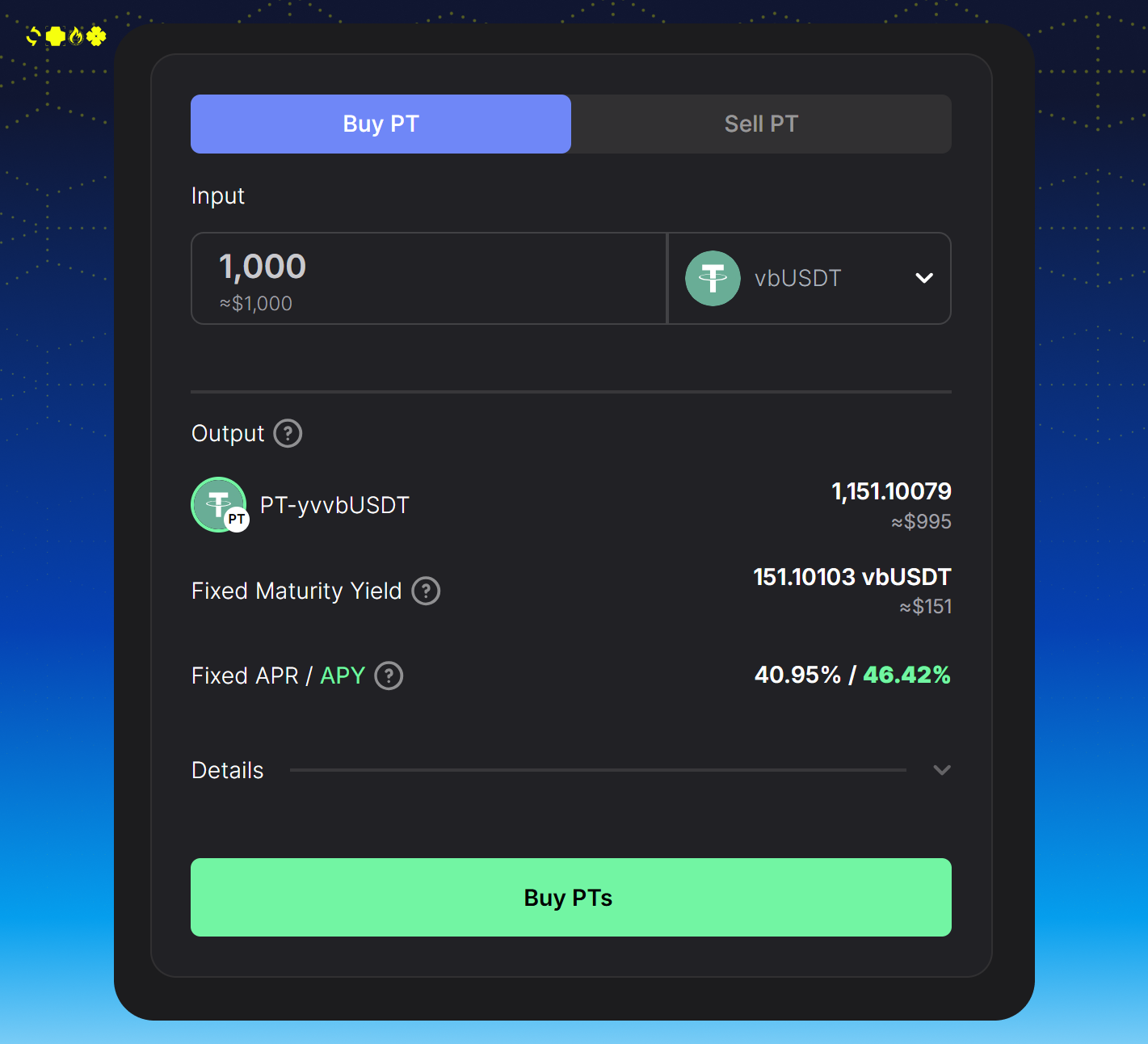

principal tokens (PTs): PTs are for users who want stability. by purchasing PTs, you lock in a fixed return at maturity. for example, you might pay $0.91 today to receive $1 of the underlying asset at maturity. PTs hedge against yield volatility and provide predictable outcomes.

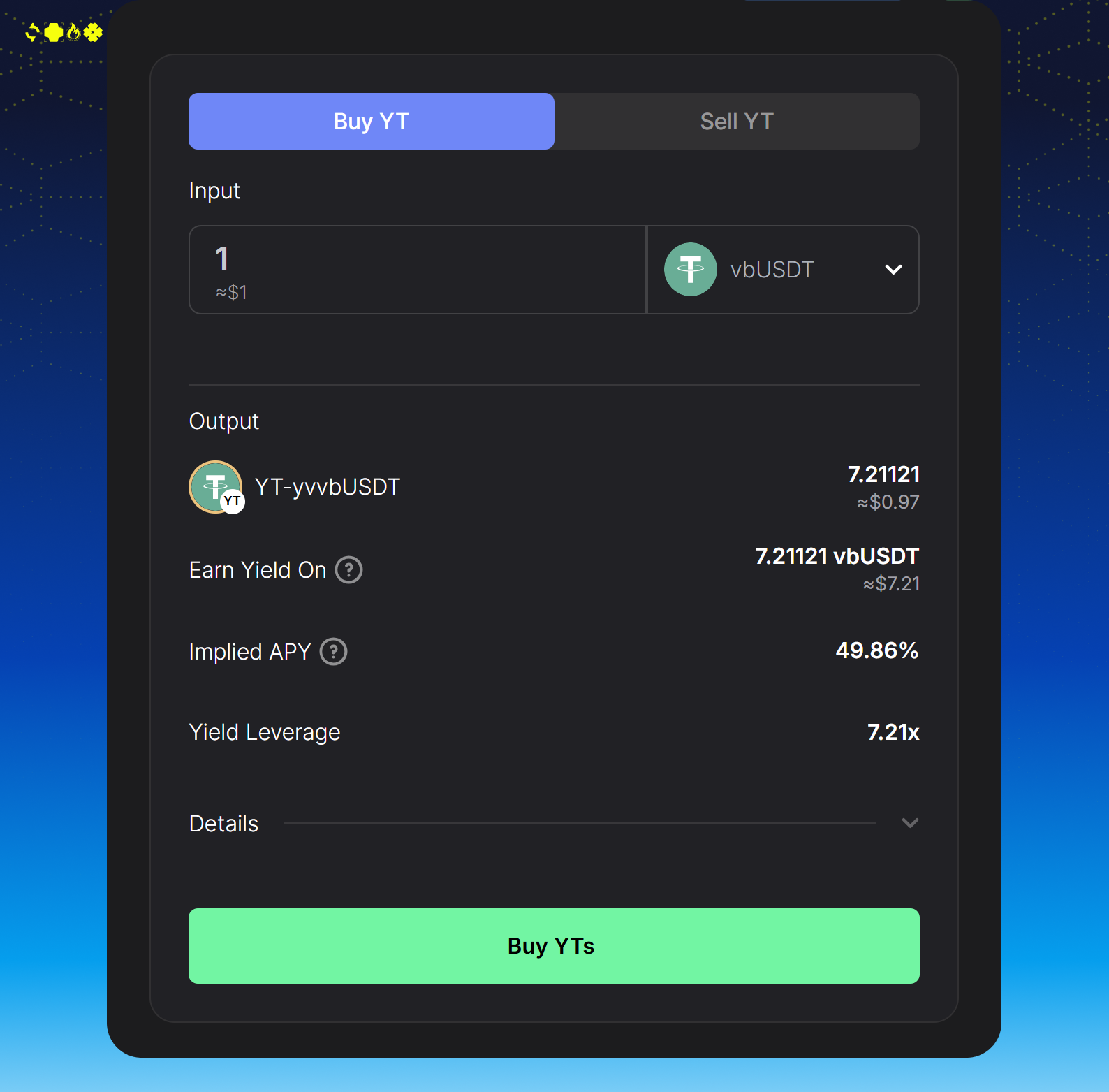

yield tokens (YTs): YTs are for users who want to take on more risk in exchange for greater upside. a YT entitles you to the ongoing yield from the underlying asset, plus katana’s KAT token rewards, until maturity. YTs decay to zero at expiry, meaning you do not reclaim your principal. profit depends entirely on whether yield and rewards exceed your entry cost.

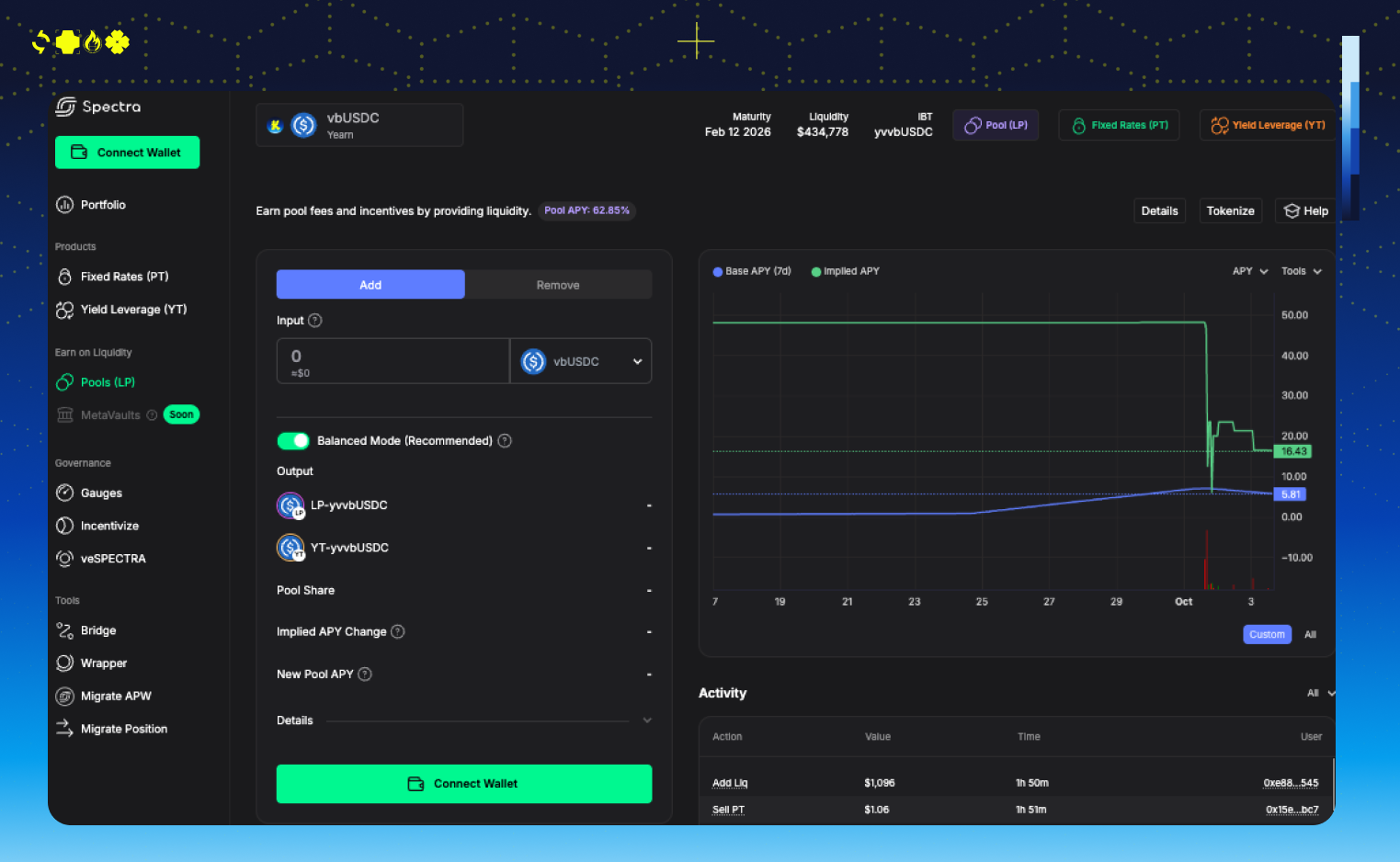

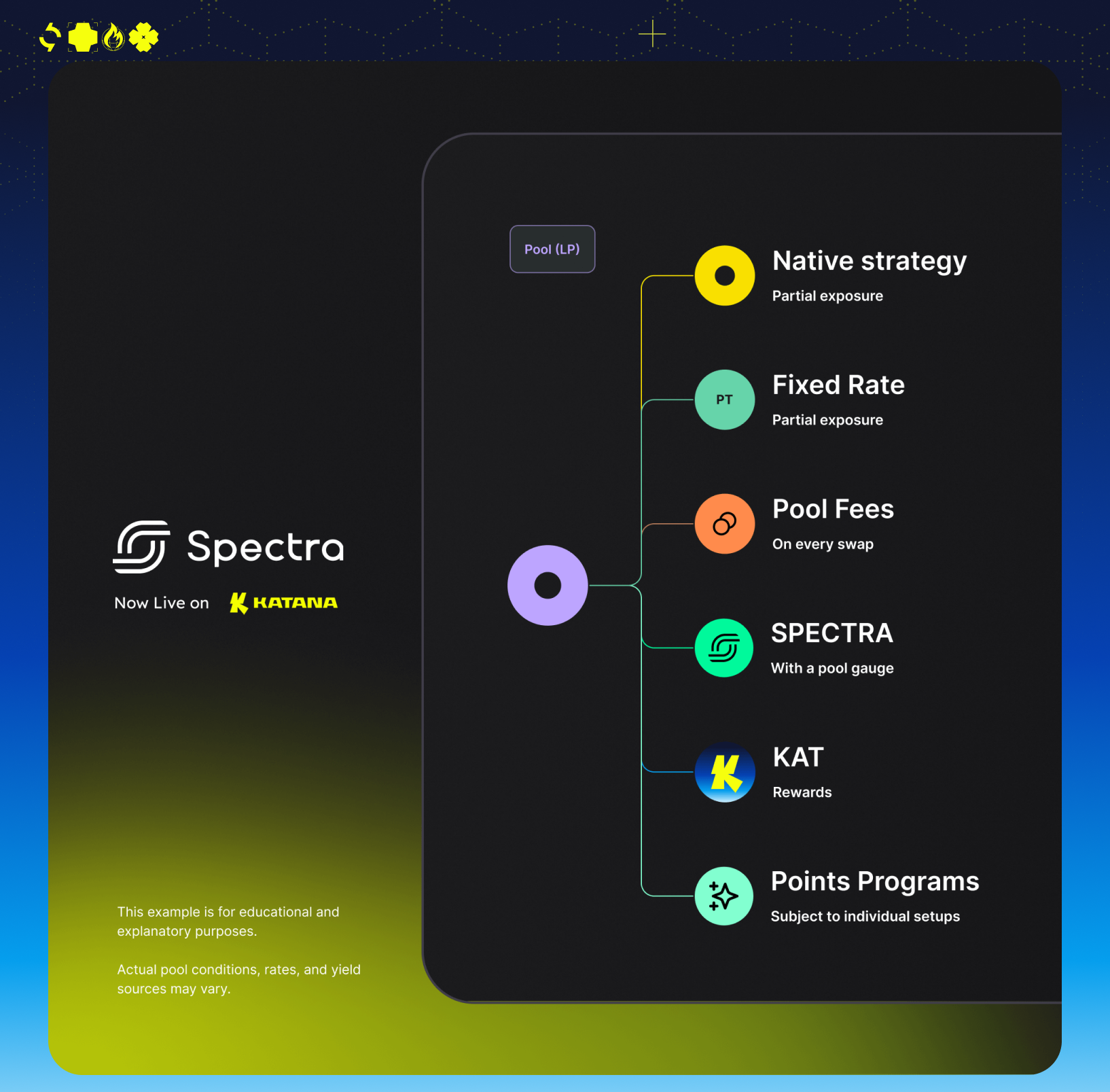

liquidity providers (LPs): LPs underwrite both PTs and YTs in spectra’s pools. in return, they earn multiple streams of income: swap fees, spectra emissions, KAT rewards, and in some cases additional partner incentives. LPs provide the balance that allows fixed and variable yield markets to function.

almighty yield tokens (YTs): for yield & KAT maxis

leveraged yield exposure: YTs provide a way to amplify exposure to yield and KAT rewards. for users confident that yield will remain high, YTs offer an asymmetric opportunity with a defined downside (aka your entry cost).

want more for the same coin? YTs let you lever up your exposure to ongoing yield and KAT incentives.

example:

normally, 1 yvvbUSDT = $1, earns ~5% + KAT rewards.

with spectra, $1 could buy ~7 YT units, each tied to that same yield stream.

translation: your dollar just got 7x sharper.

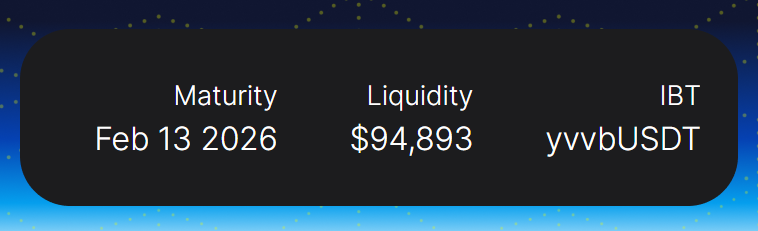

A yield token position can be swapped back to the pool anytime into available pool liquidity. Those details are clearly visible in the top area of each spectra product:

⚠️ remember: YTs decay to zero at maturity. no principal back. only the yield + rewards stream. you win when what you earn.

principal tokens (PTs): the disciplined path

fixed yield products: PTs create certainty for users who want to secure predictable returns on assets like yvvbTokens without exposure to fluctuating APYs.

for samurais who want certainty. PTs ignore floating yields and focus on fixed redemption.

example:

Buy 1 PT-AUSD for $0.90 today.

at maturity, redeem 1 PT-AUSD for $1 AUSD.

fixed return. no surprises. the best PT deals often appear when YT demand is hot, pushing PT discounts deeper.

pools (LPs): balance like water

balanced liquidity provision: LPs can take a middle path by supporting both sides of the market. this role is critical for the system and is rewarded with a diversified set of income streams.

can’t pick a side? LPs underwrite both PT + YT trades. in return, LPs earn:

swap fees

spectra emissions

katana KAT rewards (trackable via merkl)

sometimes extra points or partner incentives

balanced exposure + dojo rewards.

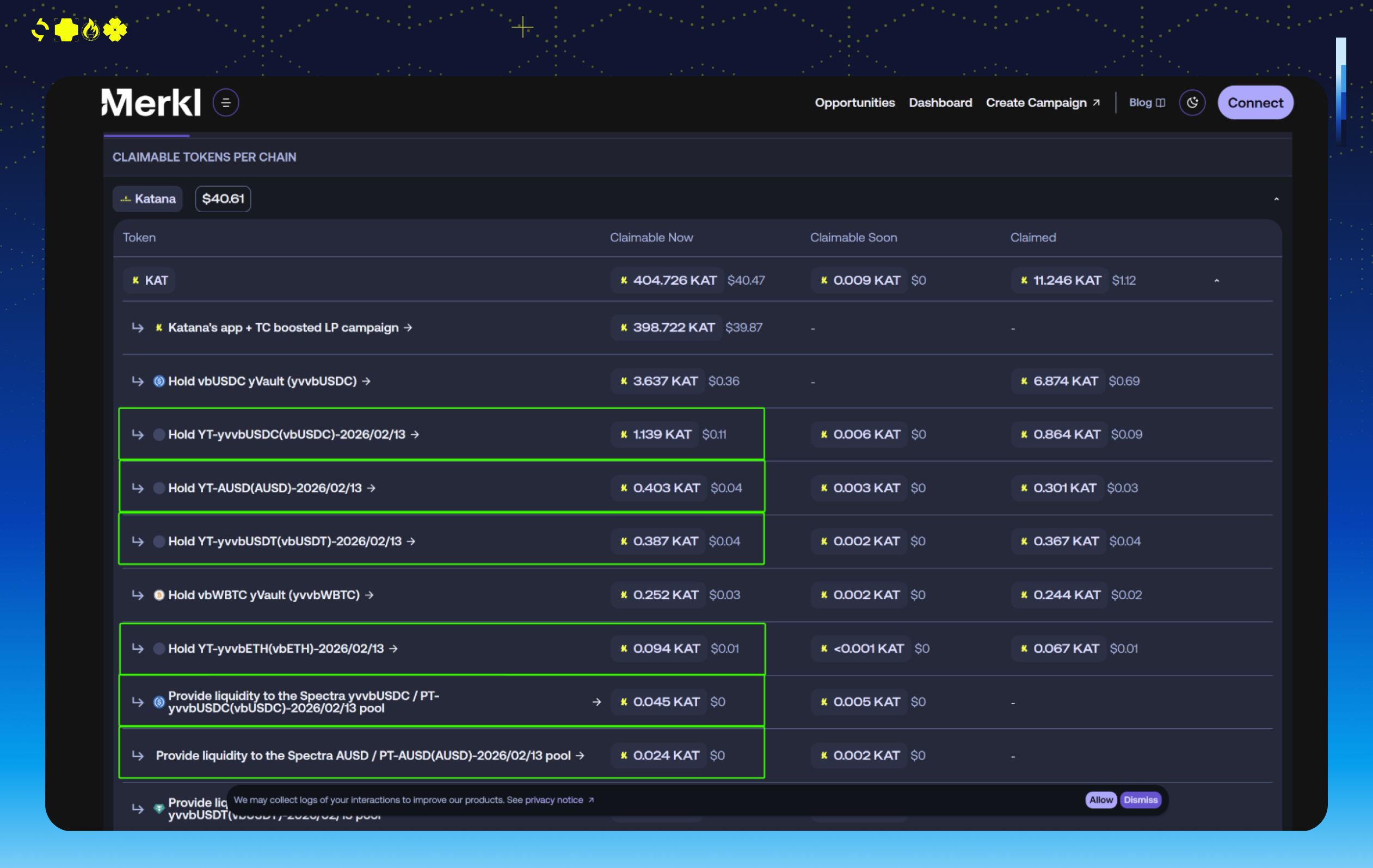

track your spoils

all spectra positions on katana, whether PT, YT, or LP, accrue rewards. these can be tracked via merkl, where rewards show up within approximately 24 hours.

this provides full transparency for users and ensures that every participant in spectra’s pools and YT holders receive the value they have earned.

direct entry points

why it matters

the deployment of spectra is another step toward katana’s vision: building a defi-first chain where liquidity is deep, yields are sustainable, and users capture the upside.

principal tokens make katana a destination for discounted stables and fixed yield.

yield tokens make katana the home for leveraged yield exposure and reward maximization.

liquidity providers keep the system in motion, underwriting both sides and earning diversified returns.

by giving users the ability to lock yield, trade yield, or provide liquidity to yield markets, katana transforms yield from something you passively collect into something you can actively manage, amplify, and weaponize.

the blade is sharper than ever. the future of defi lives on katana with spectra

FAQ: asked by samurais

can I start with vbAssets or yvvbAssets?

yes. spectra pools on katana accept both vbAssets and yvvbAssets. deposits of vbAssets route to yearn vaults to become yvvbAssets. they are either tokenized either into PTs and YTs depending on your strategy.

do I get my initial back with YTs?

no. yield tokens expire at zero when the pool matures. what you are buying is the right to the yield and KAT rewards stream until maturity. you profit if the total yield and rewards exceed the price you paid.

if I obtain spectra LP or YT by using vbUSDC, vbUSDT or AUSD, am I still exposed to yvvb yield?

yes. when you're turning any underlying token like vbUSDC, vbUSDT or AUSD into an LP position or a YT, under the hood, it is first converted into yvvbToken. meaning LP and YT users are exposed to yvvb yield and rewards.

are PTs free money?

not free, but close. principal tokens let you buy assets at a discount today and redeem them at full value at maturity. for example, you might buy PT-USDC for $0.91 and redeem it for $1 at maturity. that’s a fixed APR, with no floating surprises.

can I exit before maturity?

yes. both PTs and YTs can be sold back to the pool at any time, as long as there is available liquidity. prices will vary based on demand and time remaining until maturity.

what’s the point of being an LP?

liquidity providers underwrite trades between PT and YT holders. in return, LPs earn multiple streams of income: pool swap fees, spectra emissions, KAT rewards, and sometimes additional incentives. this offers balanced exposure to both sides of the market.

where do KAT rewards show up?

YT and LP positions on spectra earn KAT rewards, which can be tracked and claimed on merkl. connect your wallet to see the rewards you’re entitled to. KAT rewards typically appear within 24 hours after interacting with any spectra LP or YT.

who decides yields?

PT yields are fixed from day one. YT yields are variable and depend on the underlying vbAsset / yvvbAsset yield plus KAT rewards. the implied APY moves with demand, like a seesaw:

if PT demand rises, YTs become cheaper and yield leverage increases.

if YT demand rises, PTs become cheaper and fixed APRs improve.

join the katana community

stay informed, engaged, and connected:

are you a DeFi builder? join us

on katana, samurais don’t have to just hold yield anymore. they can trade it, amplify it, and weaponize it.

the blade has chosen you, do not falter.