katana x aragon: inside the vKAT armory

katana believes in DeFi so deeply that the chain’s token is itself a DeFi token. KAT is a coordination tool for users, apps, and the chain.

that’s why we’re partnering with aragon to build the vKAT armory. this is where KAT holders lock and vote to direct the flow of future KAT incentives across the chain, and earn real yield for participating.

KAT remains non-transferrable, and therefore the vKAT armory is not live, but in this post we give an in-depth look at how it works.

curve pioneered ve-tokenomics. solidly expanded it into ve(3,3). aerodrome refined the ve(3,3) playbook. and katana takes this model chain-wide for the first time, with a modified ve(3,3) structure built specifically for KAT.

aragon has spent years designing coordination systems for the biggest names in crypto like curve, lido, polygon, steakhouse, and more. together, katana and aragon are scaling this tokenomics framework to an entire defi-first chain.

why this matters

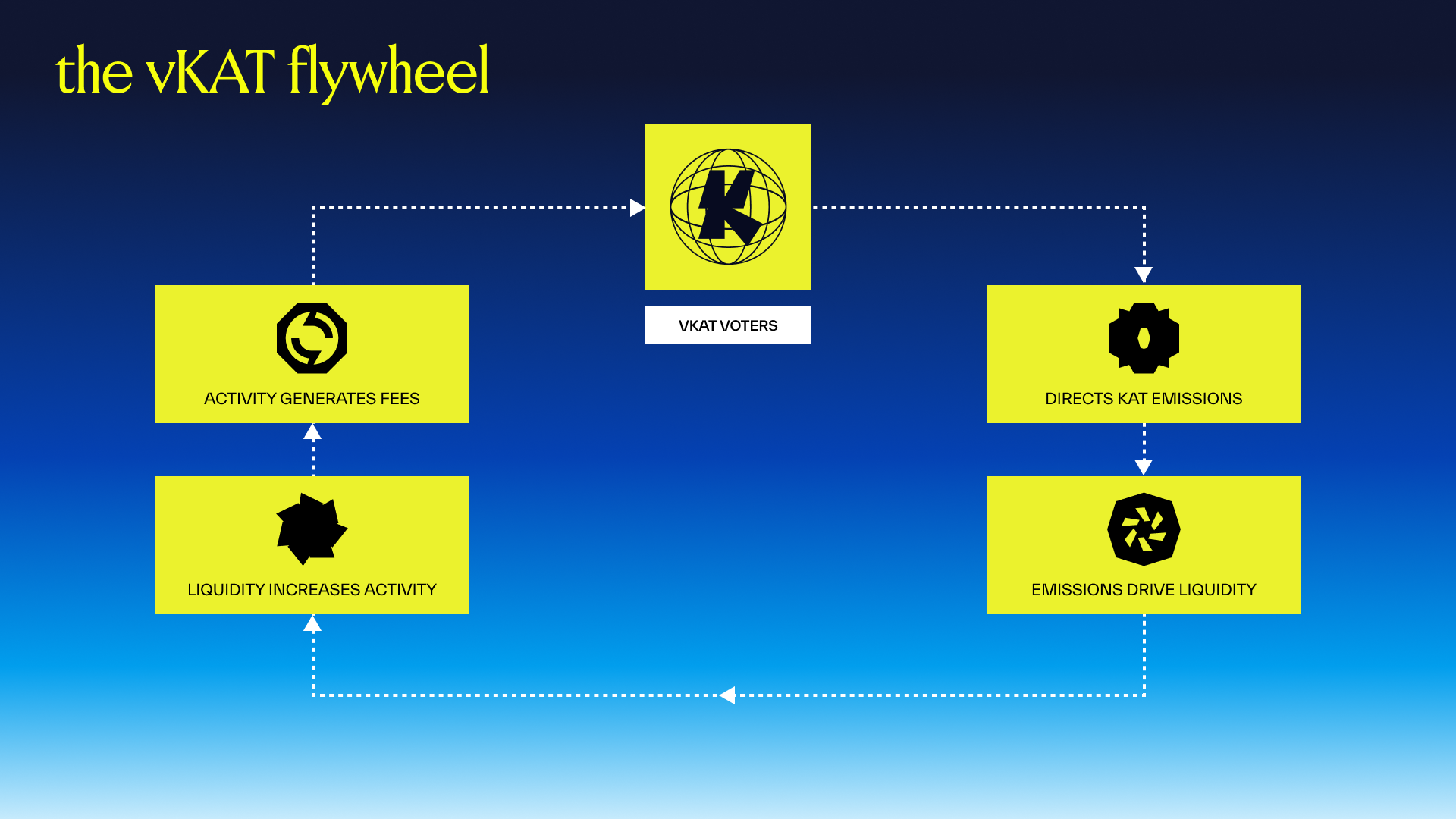

katana’s economy runs on productive TVL, chain-owned liquidity (CoL), and sustainable yield. the vKAT armory turns that into a user-controlled system. emissions voted by vKAT holders attract liquidity and spin the flywheel; exit fees reward the long-term lockers; vote incentives and relayers make participation simple.

this is the coordination layer for an entire defi chain. with aragon’s experience and katana’s design, we’re pushing defi forward for a whole ecosystem.

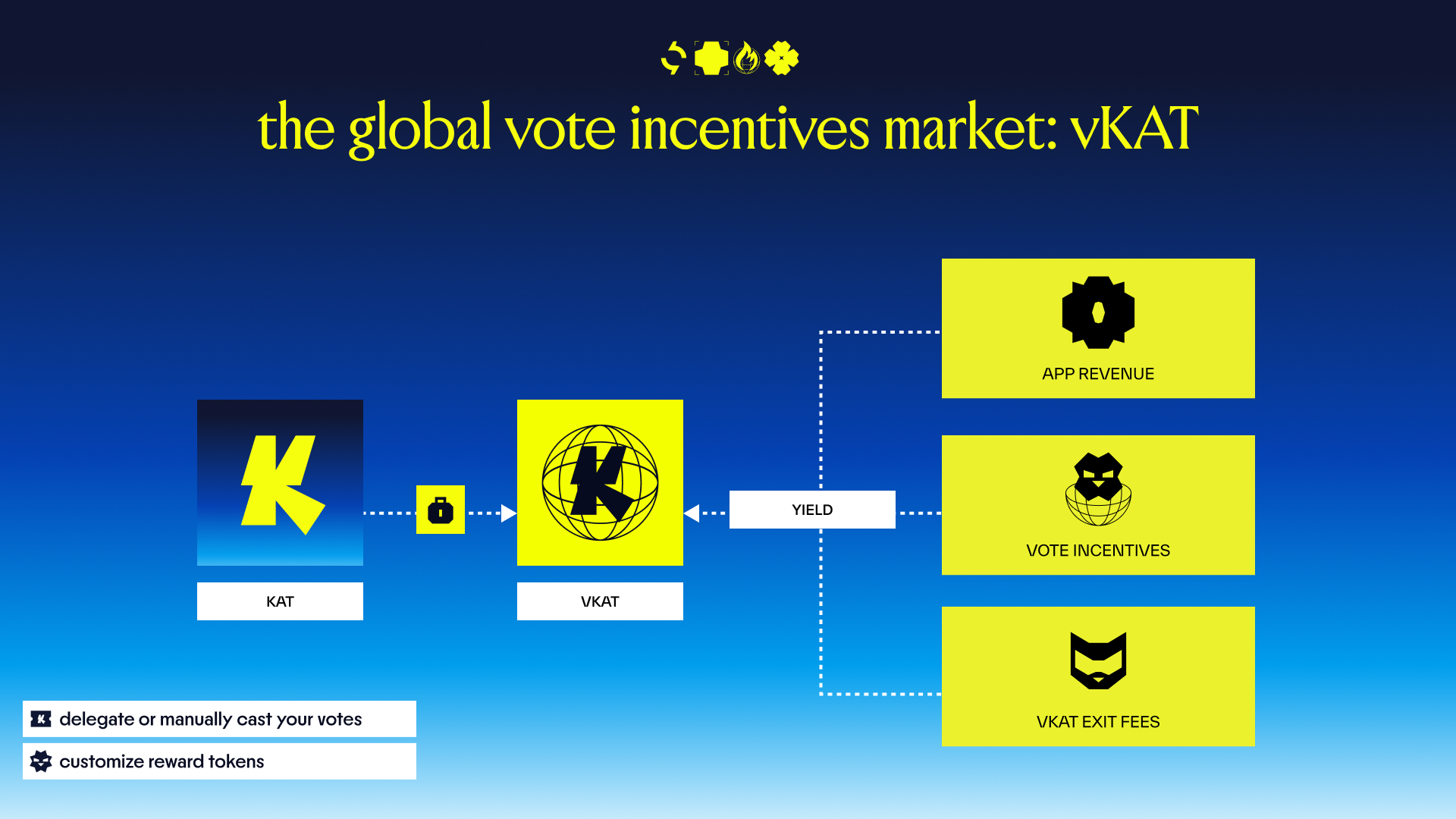

vKAT: how it works

vKAT (voting KAT) is designed to serve every layer of katana’s economy:

liquidity providers (LPs): boost your own yield by voting emissions towards the pools you supply liquidity to.

protocols & DAOs: secure emissions for your markets by attracting vKAT votes, deepening liquidity for your users.

voters: earn diversified, real yield from pool fees and vote incentives by voting to direct where KAT emissions flow.

katana users: emissions attract liquidity, liquidity drives volume, and both increase chain revenue. that revenue is recycled back into the ecosystem as boosted yield from vaultbridge and deeper liquidity from CoL, reinforcing the flywheel for everyone.

once KAT becomes transferable, holders can lock KAT and receive vKAT. vKAT is non-transferable and represents voting power. with it, holders vote where future KAT emissions go each epoch. this means voting on which sushi pools receive KAT emissions; over time emissions will extend to morpho, kensei, perpetuals DEX, a yield trading protocol, and other ecosystem apps.

by voting emissions toward specific pools, vKAT holders receive a portion of the fees generated by those pools. that means real yield going back to vKAT participants for their actions and contributions to the network. in addition, defi protocols may offer bonus vote incentives to vKAT holders who vote for their pools. rewards and vote incentives can be claimed in token(s) of the vKAT holder’s choice (KAT, USDC, WETH, WBTC, etc), giving participants maximum flexibility in both emissions direction and rewards.

vKAT lock + exit design:

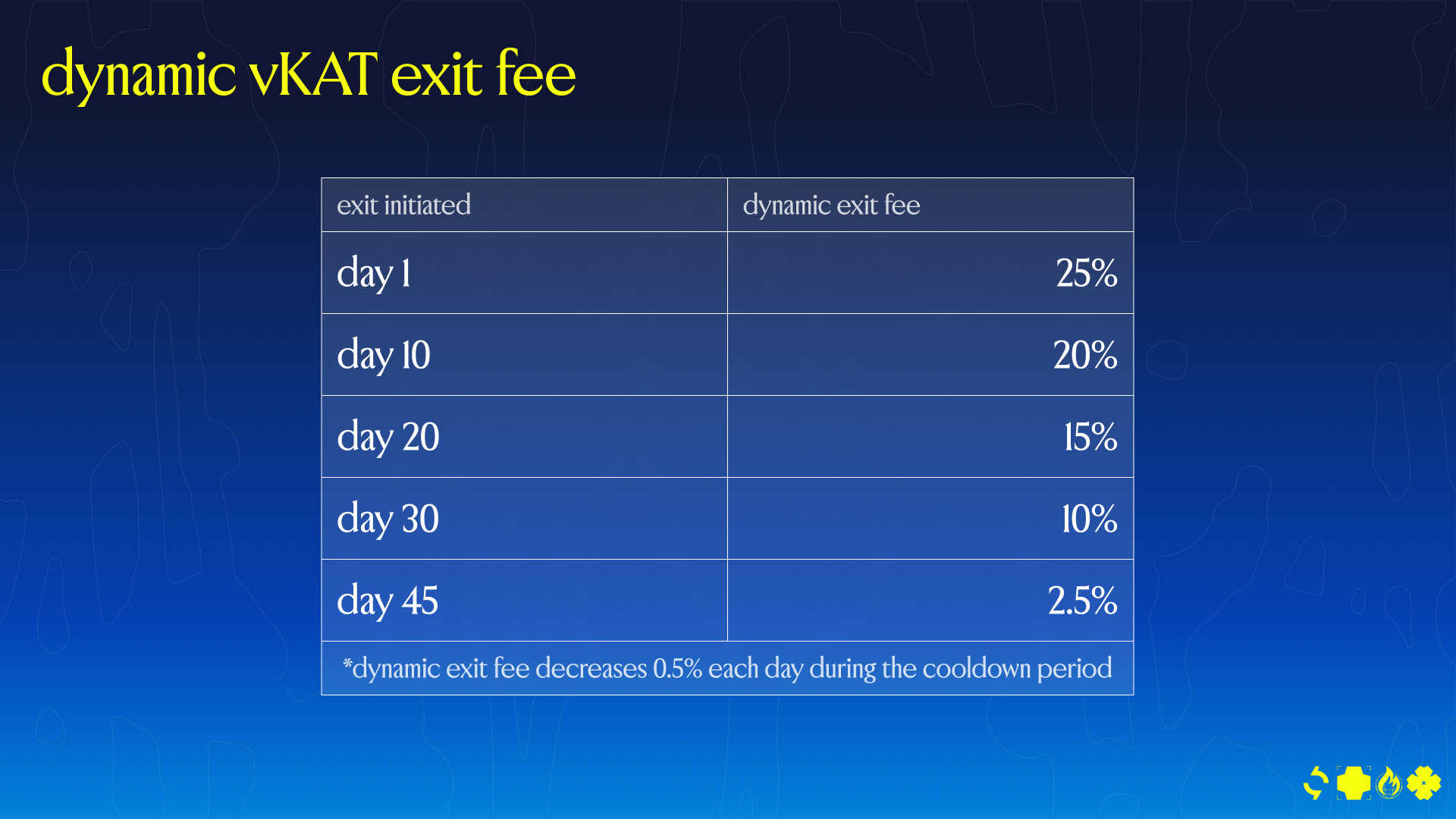

cooldown: once you initiate an unlock, your vKAT enters a 45-day cooldown period. during this time it has zero voting power and does not earn rewards.

dynamic exit fee: standard withdrawals after the full cooldown carry only a 2.5% fee. if you choose to exit early, the fee scales up linearly to a maximum of 25% for same-day withdrawal. all fees are redistributed to remaining vKAT holders.

composability: positions can be merged, split, or delegated to ‘relayers’ who automate voting on your behalf

this mechanism drives a stronger, more stable, and engaged user base, contributing to katana's overall health and longevity.

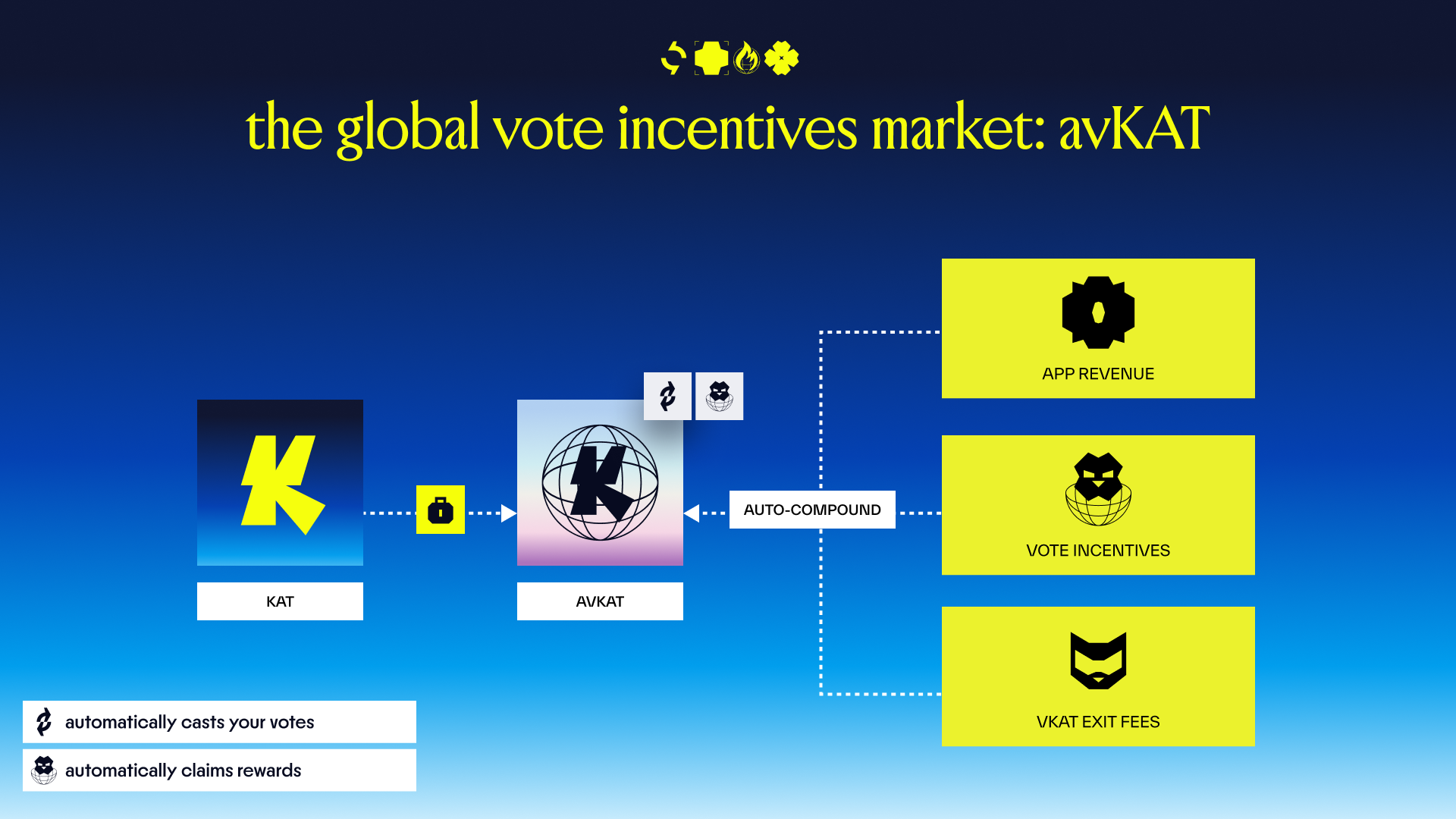

avKAT: liquid & transferable form of vKAT

avKAT (autocompounding vote KAT) is a yield-bearing transferable ERC-20 that autocompounds fees and protocol vote incentives for holders, while still actively participating and contributing to katana.

users can mint avKAT with KAT or convert vKAT into avKAT. under the hood, avKAT is simply a wrapper for vKAT. the vKAT inside avKAT is configured to vote each epoch for pools that will generate the highest yield. the yield earned by those vKAT votes is then used to market-buy KAT, which is locked back into more vKAT. this process increases both the underlying KAT balance and the voting power of the vKAT position, with all of it reflected in the avKAT wrapper.

because this cycle continuously compounds rewards into more vKAT, the avKAT:KAT exchange rate increases over time. holders don’t need to take any action, the compounding and voting strategy run automatically.

redemption: avKAT converts back to vKAT at any time with no fee. from there, you can exit to KAT using the same cooldown/exit fee rules as any other vKAT holder. if you want immediate liquidity, the alternative is to trade avKAT for KAT on sushi at market prices.

vKAT, delegations, and avKAT comparisons

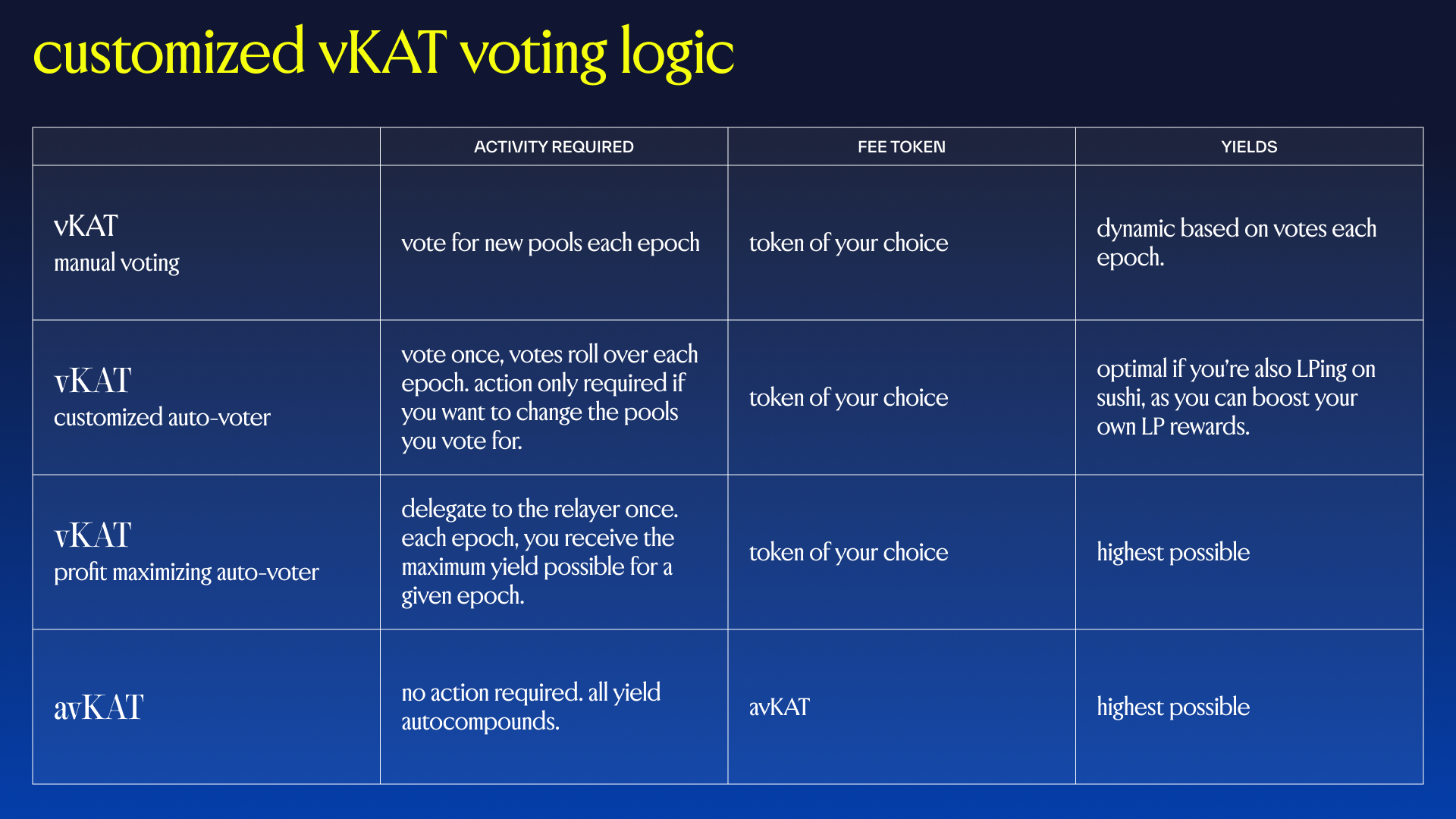

both vKAT and avKAT give users a way to automate their voting to maximize yield, but the way rewards are delivered is different.

vKAT (manual voting)

you hold vKAT and cast votes yourself each epoch.

votes roll over automatically, so you only need to vote when you want to change vote allocations

reward amounts flow back based on your chosen pools

your choice of payout tokens (USDC, WETH, WBTC, KAT, etc, or a custom mix)

vKAT + relayer (delegation)

you hold vKAT but delegate your voting power to a relayer

third-party relayers are permissionless algorithmic voting logics

the relayers allocate votes each epoch based on a pre-defined criteria

reward amounts flow back based on the strategies of the user-selected relayer

your choice of payout tokens (USDC, WETH, WBTC, KAT, etc, or a custom mix)

avKAT (autocompounding rewards)

you hold avKAT, a liquid ERC-20 that automatically uses a profit maximizing permissionless relayer voting strategy algorithm under the hood

all rewards are autocompounded back into more avKAT, so the avKAT:KAT exchange rate increases over time, reflecting that compounding yield

payout tokens are not selectable. value accrues directly into your avKAT position

tl;dr:

vKAT (manual) = full control, flexible rewards.

vKAT + relayer = automated voting, still flexible rewards.

avKAT = fully passive, compounding growth.

gauges: directing emissions

the gauge system is at the heart of the armory. vKAT holders direct KAT emissions to liquidity pools and apps across katana, starting with sushi. the model is ve(3,3)-style: voters receive fees from the pools they support and may also receive protocol vote incentives offered by the projects competing for emissions.

votes roll over automatically each epoch, you only need to vote when you want to change allocations. prefer full automation? delegate to a profit-maximizing relayer, which reallocates each epoch to wherever yields are highest.

the loop is simple: emissions → liquidity → volume → fees → back to the voters who made it happen. protocol vote incentives amplify this loop as protocols pay voters who direct emissions their way.

the vKAT armory coordination stack

aragon is delivering the vKAT armory for katana voting building off its open source token value accrual kit:

vKAT armory staking UI to lock KAT, manage positions, delegate votes

voting UI for bi-weekly epochs, emissions, results

protocol vote incentives claims to collect rewards for directing votes

indexer + backend infra to surface vKAT coordination data and power third-party integrations

locker manager for automation. relayers that auto-revote, auto-compound, and route rewards into whatever mix of tokens users prefer

Tokenomics Advisory Support to ensure the system was and is designed for the benefit of the Katana system long-term

projected roadmap

phase 1: Q4 2025 / Q1 2026

core infra live: vKAT/avKAT locker, sushi voting, gauges, indexer, backend

vKAT armory staking UI integrated into the katana app

locker manager + relayer tooling

maintenance, upgrades, analytics, optimization

phase 2: Q1 2026 / Q2 2026

rolling out vKAT voting + avKAT support across more apps

avKAT integrations into katana defi apps

risks

as with any defi system, risks exist: smart-contract bugs, short term vote concentration, market liquidity risk for avKAT. cooldowns, exit-fee redistribution, relayers/avKAT, and revenue backed emissions are designed to mitigate (not eliminate) these risks. for an extended description of risks and terms of use, visit the katana docs and katana terms and conditions at katana.network.

what’s next

phase 1 (Q4 2025 / Q1 2026) goes live soon. KAT holders will soon be able to lock, vote, and earn. if you received the vKAT bonus from the katana krates pre-deposit campaign, your vKAT will be active when the vKAT armory is live.

check out the aragon blog as well for more info.

wake up, samurai. vKAT is coming.

join the katana community

stay informed, engaged, and connected:

are you a DeFi builder? join us

welcome to katana, where vKAT turns emissions into yield, coordination, and a stronger flywheel for all.