New Katana App is Live: Your DeFi Home Screen

Introducing the Katana App v1: Your Daily DeFi Home Screen

DeFi is powerful. It can also be exhausting.

To do anything meaningful, you still bounce between bridges, swap UIs, vault dashboards, portfolio trackers, and explorers. You spend more time wiring transactions together than deciding what to do with your capital. The result is not just friction. It can mean more complexity, less clarity around risk, and a higher likelihood of missing yield opportunities.

Katana exists to fix that. The Katana App v1 is your daily home screen for DeFi on Katana.

It brings discovery, funding, and onchain opportunities into a single interface for the assets you already hold. No tab hopping. No manual routing. No guesswork.

Under the hood, Katana is a chain purpose-built for DeFi, designed to deepen liquidity, increase sustainable yield, and make capital genuinely productive across a focused set of core applications and assets. This is what allows the app to surface real opportunities instead of just links and dashboards.

This is not a concept or a preview. This is what you can do with the Katana App today.

What You Can Do on Day One (on v1)

On v1, the Katana web app is moving from beta into its first public release. Practically, that means you can:

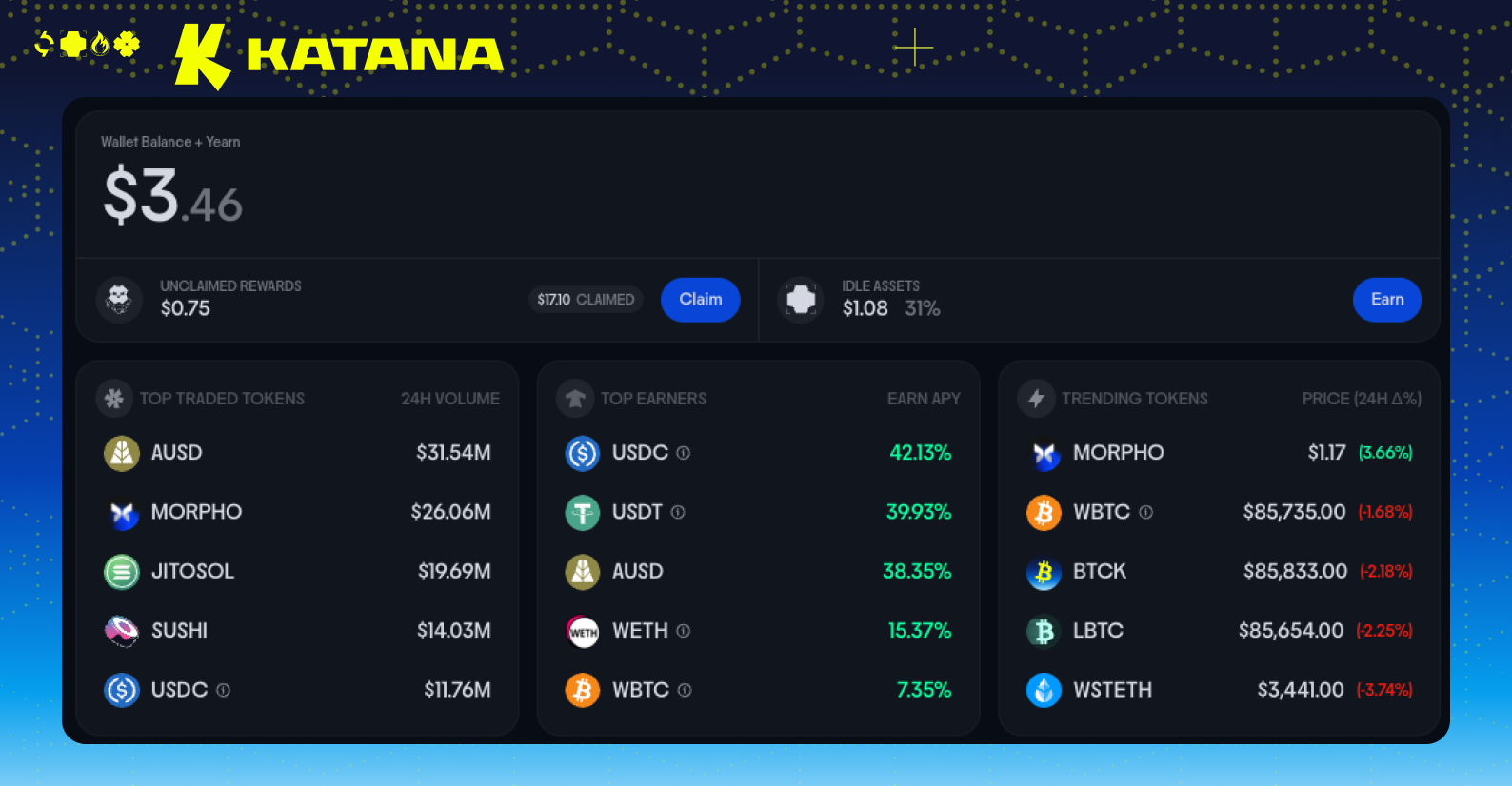

Start from tokens in your wallet, not searching for DeFi protocols

Open the app and see a curated list of tokens on Katana ranked by real onchain signals such as volume, top earners, and 24‑hour trends. For each token, you see concrete earning opportunities, with clear APYs, capacity, and a plain‑English explanation of how the strategy works.Bridge, swap, and deposit in a single flow

Take any supported token from any EVM wallet and move from “where your assets are now” to a live position in a Katana strategy in one transaction flow. The app, via Trails’ 1-click cross‑chain orchestration, handles bridging, routing, and depositing behind the scenes.Track your full DeFi footprint on Katana

View your balances and open positions across core protocols in one unified Portfolio: net worth, positions, PnL, yield, fees, and claimables in a single, chain‑aware view.Discover the Katana ecosystem from one hub

Use the Ecosystem surface as a starting point for Katana‑native and partner apps such as Sushi, Morpho, Kensei, Spectra, Yearn, and other core experiences (like Perps) as they come online.

Over time, more of these experiences will be pulled directly into the app, so this surface becomes the default entry point for everything built on Katana.

The Four Pillars of Katana App v1

1. Token-First, Actionable Discovery

Most DeFi interfaces are protocol-first. They expect users to know which apps matter, which pools are active, and which vaults are worth their attention.

Katana starts from the assets users actually hold.

Discovery view presents a curated list of tokens on Katana, ranked by onchain activity such as trading volume, top earners, and recent trends. Selecting a token reveals:

Discovery view presents a curated list of tokens on Katana, ranked by onchain activity such as trading volume, top earners, and recent trends. Selecting a token reveals:

Curated, risk‑labeled earning opportunities

Clear APYs and available capacity

Plain‑language descriptions of what the strategy is doing and why the yield exists

Instead of hunting across dashboards or trying to reverse engineer where activity is happening, you see the most relevant actions for your token and can put capital to work immediately.

2. Unified Portfolio

Understanding your real exposure in DeFi usually requires stitching together explorers, protocol UIs, and portfolio tools. It is easy to miss positions or underestimate risk.

The Katana Portfolio brings your DeFi footprint on Katana into a single, coherent view:

The Katana Portfolio brings your DeFi footprint on Katana into a single, coherent view:

Wallet balances and protocol positions in one place

Net worth and historical PnL

Yield earned and fees paid

Claimable rewards and key position details

At launch, the Portfolio focuses on positions in Katana’s core DeFi venues, with coverage expanding as the ecosystem grows. The goal is simple: give you a portfolio you can confidently check every day, not only when something is broken.

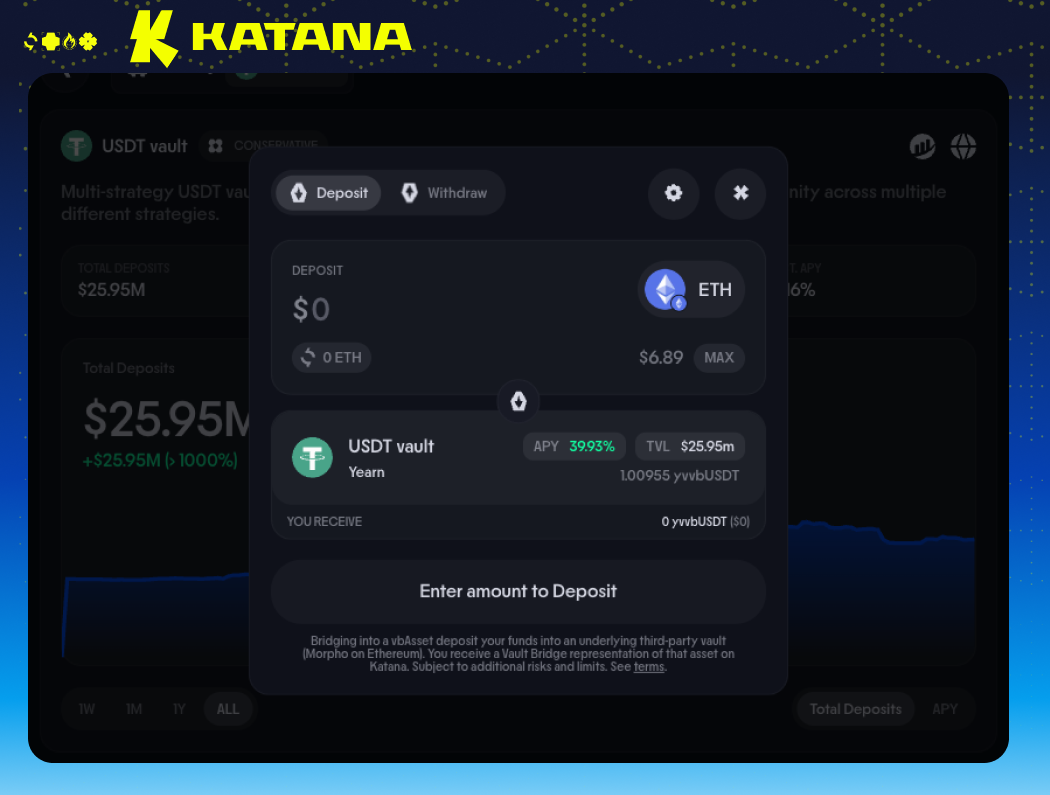

3. One-Click Bridge → Swap → Deposit

Most DeFi actions still unfold into manual steps:

Bridge assets to a new chain

Swap into the right token

Find the right vault or pool

Approve and deposit

Every extra step is another chance for users to drop off or make a mistake.

Every extra step is another chance for users to drop off or make a mistake.

The Katana App collapses this into a single intent. You choose what you want to allocate into. The app, via Trails integrated routing and cross‑chain rails, handles:

Bridging from your origin chain

Swapping into the correct asset

Depositing into the chosen DeFi strategy on Katana

Cross‑chain funding and deposits are powered by Trails, Katana’s 1‑click transaction rail, so users can bridge, swap, and allocate from any supported EVM wallet without leaving the app.

You stay in one interface, sign once, and see the final position in your Portfolio. Any chain. Any token. Any wallet. One action.

4. Ecosystem Discovery & Questing

Katana more than an app - it’s the front door to the Katana DeFi ecosystem.

The Ecosystem page is a curated directory of Katana‑native and partner apps, starting with core venues such as Sushi for spot liquidity and LPs, Morpho for lending and borrowing, and Yearn for vault strategies that sit on top of Katana’s deep liquidity layer.

Instead of chasing announcements or links, users always know:

Instead of chasing announcements or links, users always know:

Which apps are live

What they do in the broader Katana stack

Where to go next from a single starting point

As more teams launch on Katana, this surface becomes the natural index for the entire DeFi-first ecosystem.

Why We Built It

Katana is a chain designed specifically for DeFi. It concentrates liquidity and rewards into a small number of core primitives and feeds real yield back into the system through VaultBridge, AUSD treasuries, sequencer fees, and chain‑owned liquidity (CoL).

The Katana App is how this architecture becomes usable for everyday allocators.

We built it to answer three questions, every time you open it:

Where is my money?

What is it earning?

What should I do next?

The app is deliberately opinionated in how it answers those questions. A purely neutral list of thousands of options creates noise, not clarity. Instead, the app surfaces a constrained set of high‑quality opportunities aligned with Katana’s design for productive TVL, deep liquidity, and sustainable yield.

Opinionated Surfacing on a Permissionless Chain

Katana the chain is fully permissionless. Anyone can deploy contracts, launch new markets, and build novel strategies.

The Katana app, however, is deliberately curated. It surfaces and incentivizes only those markets that meet Katana’s transparency and risk-management standards. That includes:

Which markets receive KAT rewards

Which markets are boosted with yield earned via VaultBridge and AUSD Treasuries

Which markets receive Chain-Owned Liquidity (CoL)

This doesn’t make strategies risk-free; smart-contract, oracle, and market risks always exist. It does mean the default path in the app is designed for transparent, onchain, risk-adjusted returns and not just necessarily maximizing for the highest APY. This is how Katana aims to offer a calmer, more trustworthy DeFi experience while remaining permissionless at the protocol deployment level.

What’s Next

Phase 1: “Forging the Katana” (Launch) - Discovery, Portfolio, one-click funding, sharp new look.

Phase 2: “Sharpen the Blade” (Next) - Leaderboard tiers, referrals, and Quests + XP to reward consistency and exploration.

Phase 3: “Open the Armory” (TGE Week) - The vKAT Armory allows users to stake KAT for vKAT and vote where future KAT rewards are directed in the Katana DeFi ecosystem (and earn from their votes).

Phase 4: “XP → Power” (Post-TGE) - XP can be converted into avKAT or Spins/Krates for randomized rewards, with public stats on usage and retention.

A Note on Risk

DeFi carries risk, all finance does.

The app highlights strategies and opportunities that pass Katana’s transparency and risk management standards, but there are no guarantees in markets. Isolated markets, conservative parameters and deep liquidity are designed to limit blast radius, not eliminate it.

Some opportunities in the app rely on independent third-party protocols and providers (Morpho, Yearn, Sushi, VaultBridge, etc) and external risk curators (Gauntlet, Steakhouse Financial, etc). These parties operate independently; Katana does not custody bridged assets or control third-party strategies, and outcomes can depend on those systems.

Where VaultBridge is involved, deposits route into Ethereum-side vault strategies and you receive vbTokens for use on Katana; vbTokens are not yield-bearing, and withdrawals may be delayed during periods of stress.

Always review the details in-app and on chain and size positions accordingly.

The Bottom Line

Katana’s web app v1 turns DeFi from a maze of explorer tabs into a single, daily home screen.

It helps you:

Discover curated, risk‑labeled opportunities for the assets you already hold

Move from any supported chain and token into a live strategy in one end‑to‑end flow

See your positions and activity across core Katana apps in a unified Portfolio

Navigate the broader Katana ecosystem from a single starting point

Make one allocation today. Come back tomorrow. If Katana does not feel meaningfully simpler and more coherent than your current DeFi setup, we have more work to do.

Join the katana community

Stay informed, engaged, and connected:

Are you a DeFi builder? Join us

The path is clear, the rails are live. Step into the dojo, and let your capital stay in motion.

the blade has chosen you, do not falter.