Katana Q3 2025 Recap

Key Takeaways

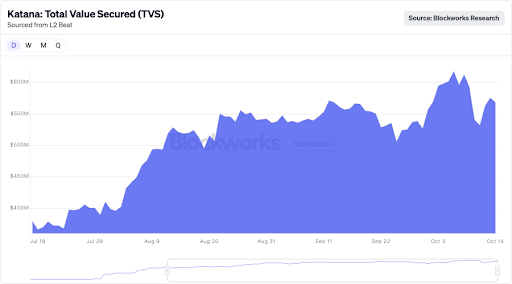

• Surging DeFi TVL: Katana’s productive TVL grew rapidly in its first full quarter of public operation, reaching roughly $500 million by September 30, 2025. This reflects solid capital inflows since launch (July 1, 2025), with nearly 95% of assets actively deployed in DeFi protocols, indicative of “productive TVL” over 95%

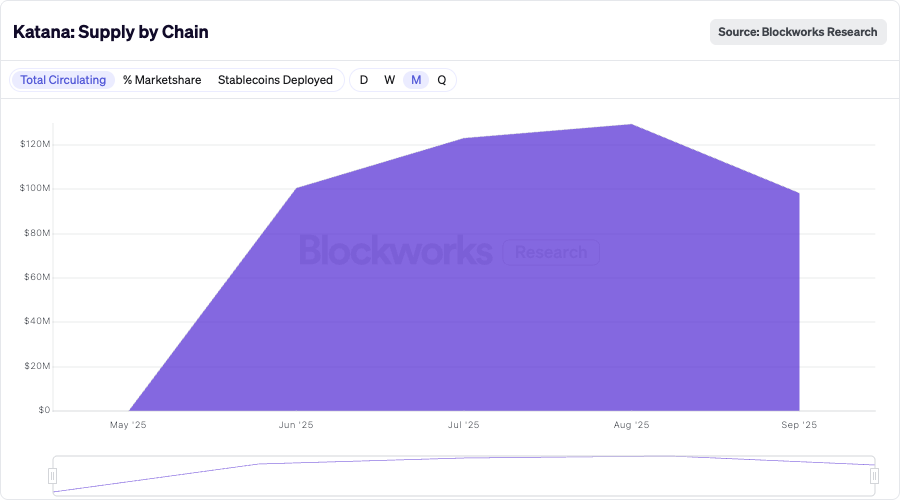

Expanding Stablecoin Supply: The circulating stablecoin supply on Katana surpassed $100 million during Q3, and stood around $98 million by quarter-end. Notably, over 50% of this was vbUSDC (bridged USDC via vaultbridge). The underlyin USDC is deployed to yield strategies on L1. That yield is used to boost the yield in DeFi pools on Katana; vbUSDC itself does not rebase. However, many users choose yield-bearing wrappers like yvvbUSDC on Katana. Katana’s native stablecoin AUSD (backed by Treasuries) comprised roughly 27% of the stablecoin market by Q3’s close.

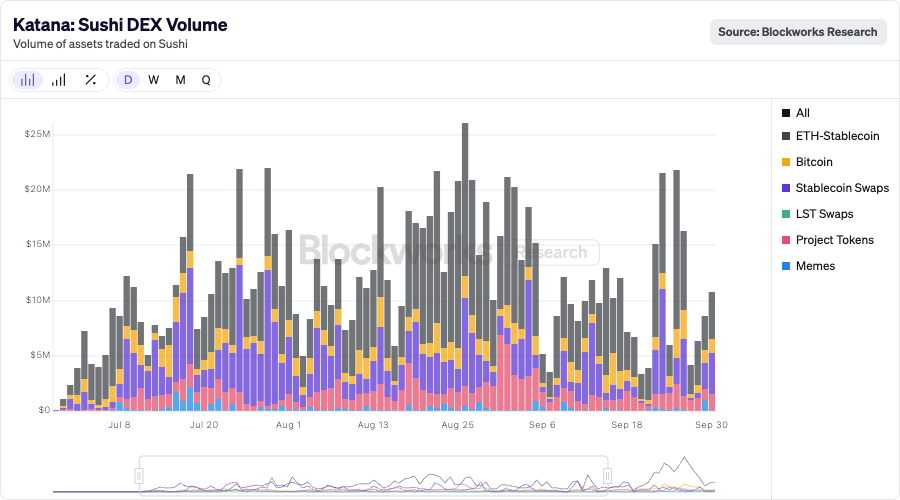

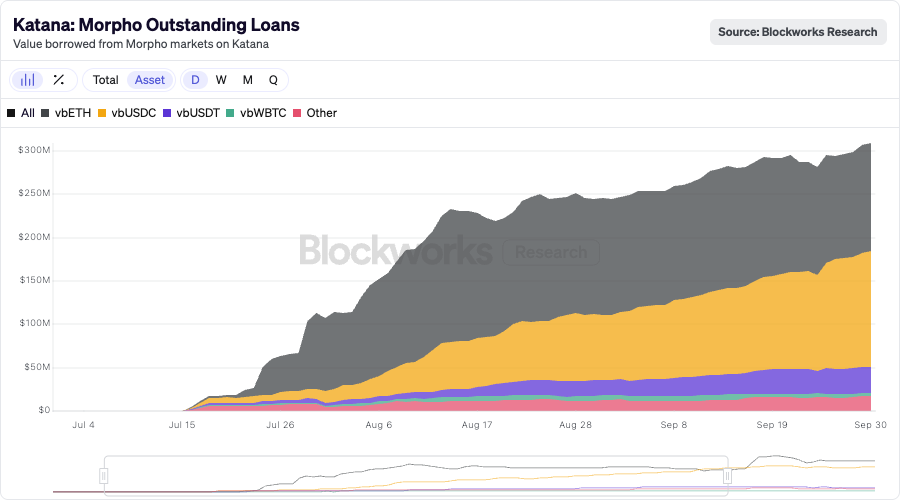

Robust DeFi Activity: Katana’s core DeFi protocols saw strong usage. The Morpho lending market reached about $260M supplied with $130M borrowed, implying deep liquidity and ~50% utilization. On the DEX side, Katana (via Sushi v3) achieved ~$195M in trading volume over the last week of Q3, a ~63% increase week-over-week – averaging $40M+ daily DEX volume by late September.

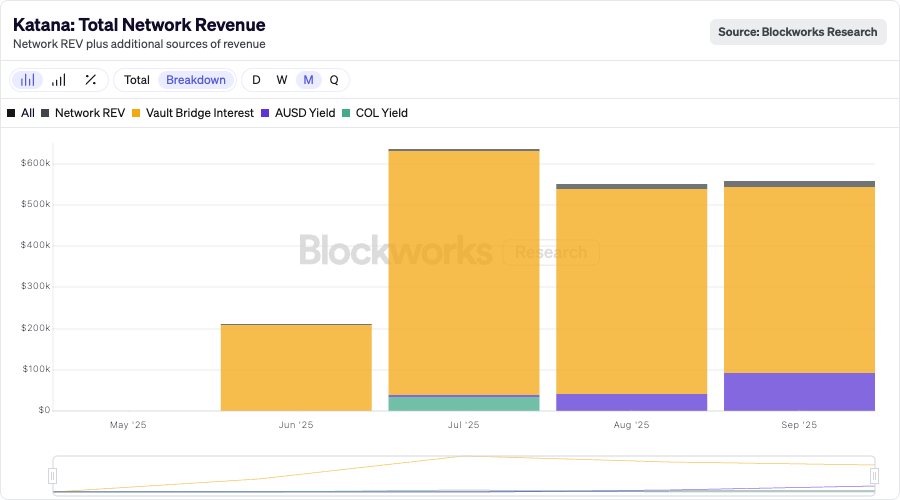

Yield-Driven Network Revenue: Thanks to its unique design, Katana’s financial inflows are driven more by onchain yield than transaction fees. In Q3, the network accrued roughly $1.6 million in yield from its vaultbridge (depositing bridged assets into Ethereum DeFi for yield). By contrast, traditional transaction fee revenue (“Network REV”) totaled only about $29,000 after L1 costs, reflecting the low fees for users. An additional ~$37,000 was earned via chain-owned liquidity deployments. All these revenues cycle back to the ecosystem, bolstering liquidity or rewarding active DeFi users though real-yield liquidity mining, underscoring Katana’s DeFi-first value alignment.

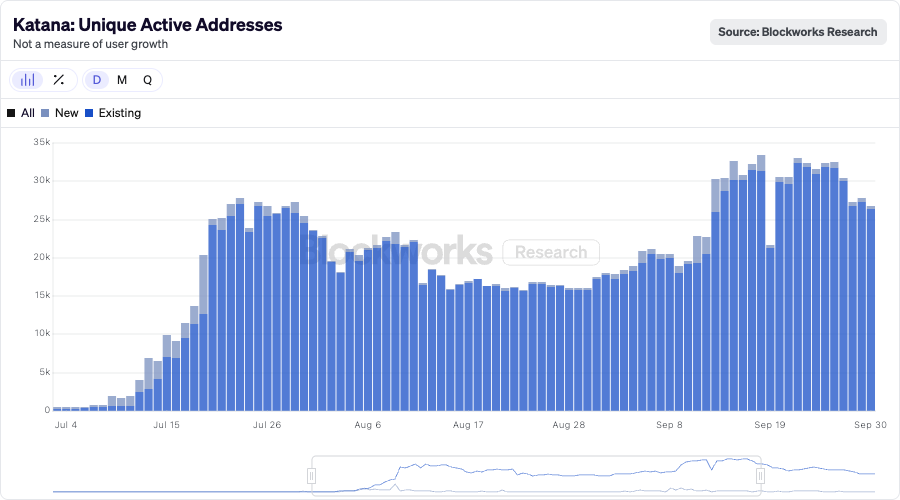

User and Network Growth: Daily transaction activity on Katana climbed throughout Q3. The chain averaged on the order of 50–80K transactions per day in late-quarter (≈0.5–1.0 TPS), with a peak day of ~255K transactions (~2.95 TPS on July 21). High throughput and near-perfect success rates were maintained, showcasing the network’s scalability. Katana’s aggressive growth was enabled by strong relationship with core apps, smart KAT incentives, and real yield liquidity mining from vaultbridge.

Overview: Katana’s DeFi-Focused Layer-2

Katana went live to the public in late June 2025 as a purpose-built ecosystem concentrating liquidity into a few core protocols. Katana’s model channels activity into core flagship apps, Sushi (AMM DEX), Morpho (lending/borrowing), Kensei (token launchpad), and more in the works. All supported by mechanisms of the Katana flywheel: vaultbridge yield, AUSD T-bill yield, Sequencer fees, Chain-Owned Liquidity (CoL), and revenue generated by CoL. This unified approach aims to reduce fragmentation of liquidity, providing deeper pools and better yields for users.

Under the hood, Katana leverages Vaultbridge, where key bluechip bridged asset can be deposited into yield vaults on Ethereum (Morpho) before arriving on Katana, so funds start earning yield immediately. Meanwhile, 100% of net sequencer fees fund CoL; additional chain revenues (vaultbridge, AUSD, CoL yield) are used to deepen liquidity, boost yield in DeFi pools, and reduce user costs over time. This treasury is redeployed into Katana’s DeFi pools to stabilize liquidity and generate additional yield for the network. In sum, Katana’s design recirculates value to its users and liquidity pools, aligning network growth with DeFi activity.

Outlook and Future Considerations

Q3 2025 demonstrated strong early traction for Katana, with rapidly growing liquidity, active use of its core DeFi protocols, and a novel revenue model that already generates meaningful returns for the ecosystem. Looking ahead, areas for future growth include:

New Protocol Launches: Expanding the core app lineup beyond the initial trio with the launch of a Perps DEX and yield tokenization protocol. Other key integrations of yield-bearing stablecoins and real-world asset integrations will further broaden Katana’s appeal. Each new protocol is likely to bring in fresh TVL and users.

Community and Ecosystem Incentives: Continued liquidity mining, vault rewards, and a KAT staking/vKAT launch will further engage the community. vKAT Armory infra rolls out in Q4'25/Q1'26, but user locking activates when KAT becomes transferable (no later than Feb 20, 2026). Longtime users might also be rewarded with new community mints or point mechanics in the coming quarters. As the 9-month token lock winds down towards early 2026, plans for rewarding long-term participants will be key.

Market Conditions: Broader crypto market trends (ETH price, DeFi sentiment) will influence Katana’s growth. Q3’s crypto market trended up yet was relatively stable, but any Q4 rallies or increased DeFi yields could accelerate Katana’s metrics even more. Conversely, risk-off sentiment could test the stickiness of Katana’s TVL.

In conclusion, Katana’s first full quarter of operations has been highly promising. The network successfully leveraged its DeFi-first architecture to accumulate significant liquidity and user activity in a short span. With its revenue recycling model, every uptick in usage directly strengthens the platform’s fundamentals, a positive feedback loop that bodes well for Katana’s long-term sustainability. As the project moves into Q4 2025 and beyond, the foundation’s strategies will play a crucial role in guiding Katana toward becoming a leading destination for yield-focused DeFi. The Q3 data already tells a compelling story: Katana is carving out a unique and growing niche in the multi-chain DeFi landscape.

join the katana community

stay informed, engaged, and connected:

are you a DeFi builder? join us

Thanks to Blockworks Research for the data visuals. You can view the entire Katana dashboard here.