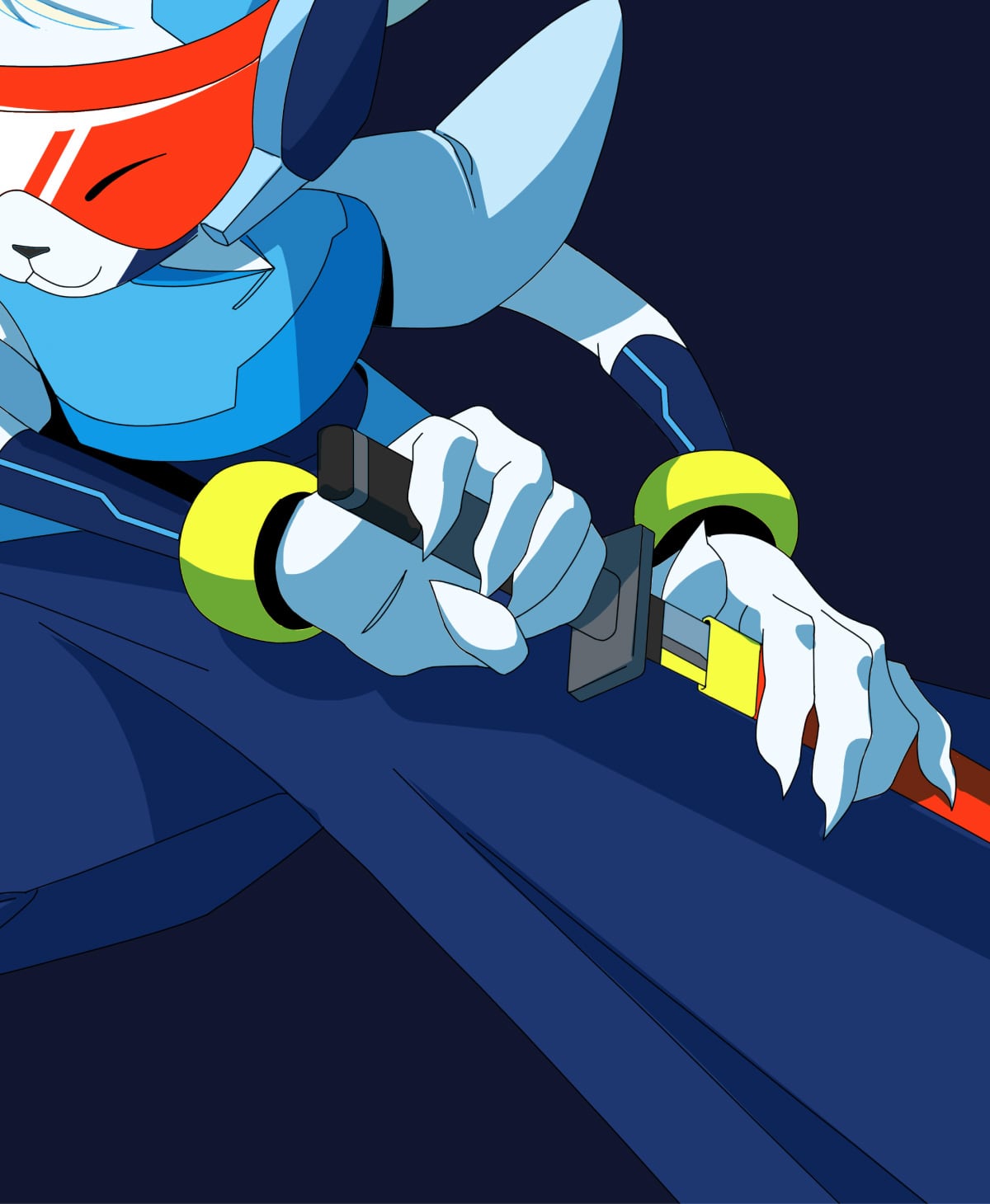

katana is committed to giving you more. deeper liquidity and higher yield.

core defi apps and assets concentrate liquidity to give you the best user experience

multiplied yield sources = sustainable, boosted yield

winner, winner, samurai dinner

your bags earn yield on ethereum when you bridge USDC, ETH, WBTC, or USDT to katana, creating a revenue stream that flows back to the network.

your katana assets go to work on day one, creating higher yield opportunities for everyone. you don’t even have to lift a finger

100% of net katana sequencer fees build baseline liquidity for more stable rates, deeper pools, and less slippage. this makes liquidity for any market, bull or bear.

apps bootstrap their offering by building on this baseline liquidity without relying on token emissions, growing faster than anywhere else.

death to idle assets. deep liquidity and high yield: a cycle where everyone wins.

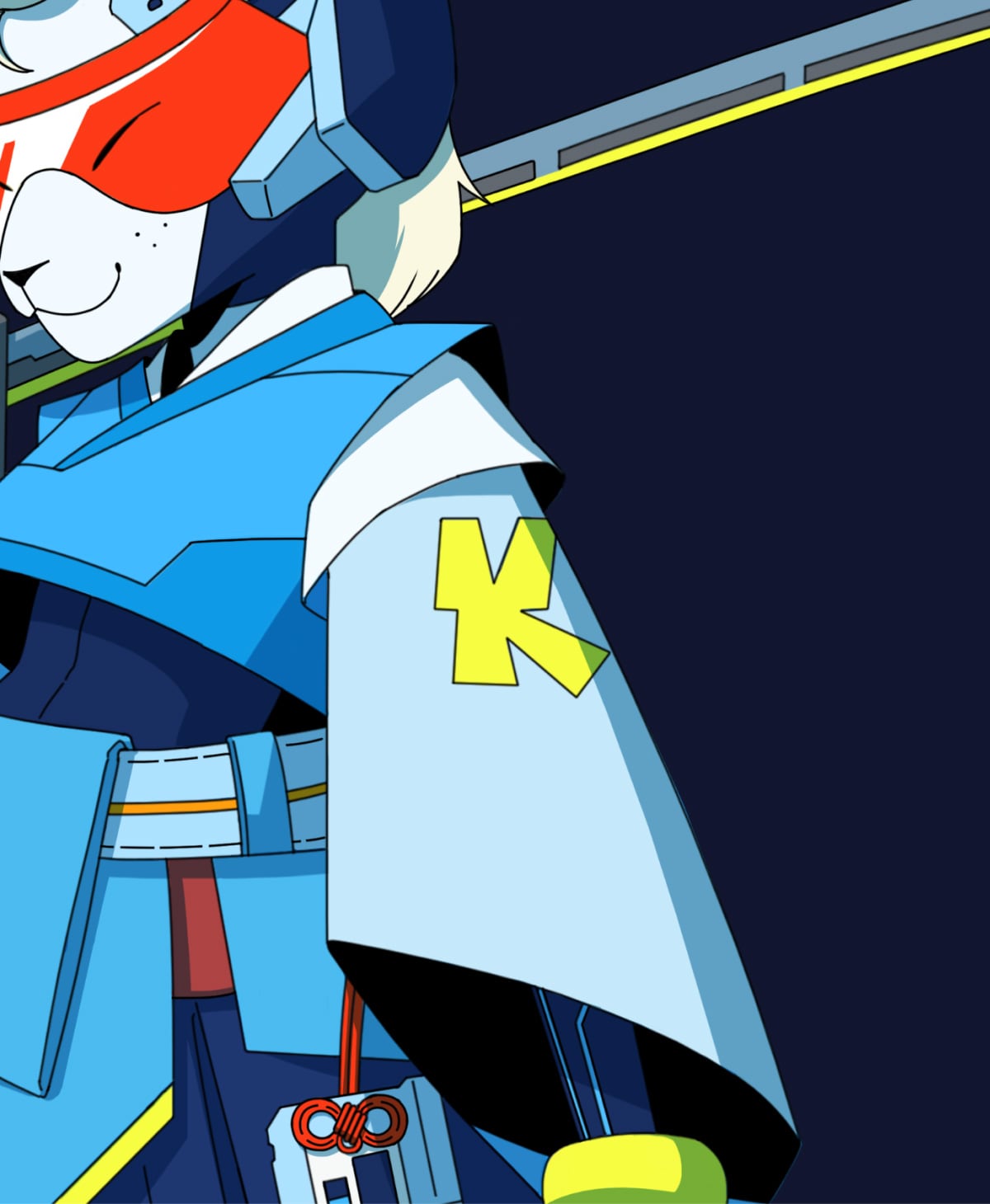

AUSD

katana's native stablecoin, backed by offchain US treasuries. AUSD is issued by agora, the reserves are custodied by state street and managed by vaneck. AUSD brings offchain yield onchain, routed directly to katana. supports liquidity incentives across AUSD-denominated lending markets and DEX liquidity pools for diversified offchain yield incentives.

vbTokens

users receive 1:1 wrapped vbTokens of certain bridged assets. behind the scenes, bags go to work in low-risk defi strategies on ethereum, generating real yield. on katana, vbTokens unlock boosted rewards when actively deployed in core applications. holding vbTokens passively does not accrue yield, they must be active

over $240m in pre-deposits from early samurai and 200k krates opened

katana is live. active users tap real yield, deep liquidity, and day one access to the best protocols

users get what they want and network effects kick in. more activity → higher yields → deeper liquidity → more activity.